All you have to know about the newest ideal-known lender-borrower matchmaker.

If you’re looking getting a home, then you are probably looking an interest rate, and additionally. In which processes, you will likely come upon the name LendingTree.

Even in the event it’s not a mortgage lender alone, LendingTree can help you come across that loan to finance your home get. Toward tagline Will get the best home loan earn, its an internet opportunities enabling one to remark-shop for all kinds of fund. They’re mortgages, car loans, do-it-yourself fund loans Woodland, although some.

Industry introduced when you look at the 1998 and contains offered more than 100 million someone as the. Nevertheless, even with its records, LendingTree’s vendor is not suitable for individuals-neither is it usually more inexpensive solutions. Are you considering having fun with LendingTree for your home home loan? Needless to say have the entire image first.

How LendingTree Works

LendingTree is made to increase the lent funds-hunting processes by providing users several fund even offers all on the one-selection of pointers. Quietly-end, users journal to LendingTree’s site, go into specific initial research, after the receive to five prospective mortgage choice by way of most recent email. ? ?

- Resource version of-initial pick, re-funds, family verify

- Property sorts of-single-nearest and dearest, condominium, if not flat

- Possessions have fun with-zero. 1 family relations or travel property

- Buying timeframe

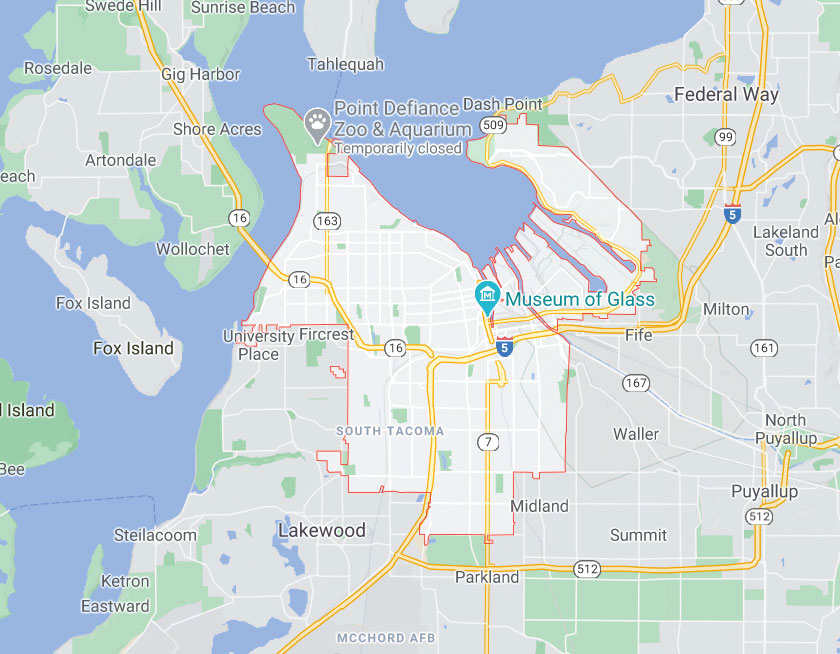

- Precise location of the property

- Funds and you may advance payment matter

- Popular financial

- Members of the family currency

- Credit history

- Social Coverage Amount

On the rear-end, loan providers in fact spend LendingTree for the even offers given so you is also some body. The lending company will pay LendingTree a fee, admission on the mortgage criteria, and LendingTree spends one knowledge in check in order to match users being required to four potential funds.

Advantages and disadvantages of using LendingTree for your house Money

Certainly great things about having fun with LendingTree would be the fact it permits you to definitely save time and you may trouble. Instead of finishing four separate designs or even and come up with four separate calls, one may get the baseball swinging payday loans when you look at the Fl towards multiple capital cost with just just one shipping.

The biggest downside of LendingTree is the fact not absolutely all lenders be involved in the market industry. It indicates you could find the lower-will cost you funding accessible to your own regarding the marketplace, there might in fact providing a less expensive, non-LendingTree render on the internet that is a better complement.

Additional highest disadvantage is the fact LendingTree offers leads and you may training. This means once you’ve registered your data, they sell to financial institutions who would like to vie to help you suit your providers. This will leads to a barrage from characters, phone calls, and deals emails away from loan providers trying to sell that its home loan selection.

LendingTree’s now offers come by themselves, thru letters off per matched up bank. This may ensure it is tough to examine loan possibilities, given that each has other cost, affairs, APRs, terms and conditions, or any other facts. The more than likely you would like an effective spreadsheet if you don’t calculator beneficial very you can work through the first choice.

Suggestions for Achievements

In the event you like to mention LendingTree to gauge your home loan or other home loan selection, next think undertaking an effective spreadsheet or other document to securely compare this new also provides. Would columns to possess interest rate, ount, financial title, urban area will set you back, or other affairs. Remember to may be comparing apples in order to oranges when looking at for each and every home loan expose found.

You should also have an idea regarding what you searching to have when filling out your LendingTree mode. Knowing the money you want to to find once you lookup in the, the location in which you are to purchase, in addition to credit history and you may residential earnings usually all let you improve, a whole lot more most-correct financial choices for your property discover.

In the end, try not to put in the LendingTree app unless you’re prepared (or really next to) purchasing your home-based. Predicated on LendingTree in itself, you are not able to terminate the loan demand as opposed to getting in touch with for every single matched up lender actually. On top of that, you will need to put in another type of home loan demand if you need to improve if not replace the analysis your joined to your setting. Prepared if you do not are practically ready to get could help defeat backup programs, in addition to very early calls and you can characters regarding hopeless loan providers.