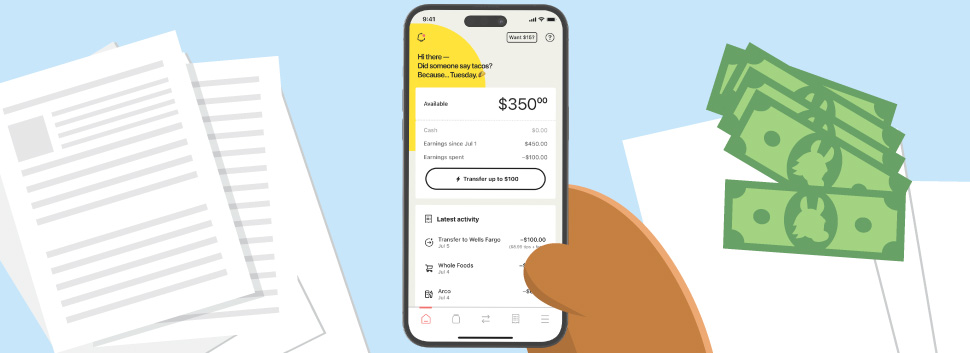

Looking to purchase a property and just have home financing sometime in the future? Understand what you will end up joining that have ‘s mortgage repayment calculator. Understanding how far your monthly home loan repayments is is a must of having a home loan that you could manage.

All of our mortgage payment calculator helps guide you far you will need to shell out every month. You can also evaluate circumstances for various off payments number, amortization symptoms, and you will varying and you will repaired financial rates. Additionally exercise the home loan standard insurance fees and home import tax. Advertising Revelation

To utilize the newest calculator, start by going into the purchase price, next get a hold of an enthusiastic amortization months and you can financial speed. The brand new calculator reveals the best costs available in your own province, but you can also add another rate. Brand new calculator Atwood loans often today make suggestions what your mortgage payments commonly getting.

Automatically, the borrowed funds payment calculator will teach four more monthly premiums, with respect to the size of the advance payment. It will instantly estimate the expense of CMHC insurance coverage. You could potentially alter the sized your own down payment and the percentage volume observe how the regular fee was affected

The calculator in addition to teaches you exactly what the home import taxation have a tendency to end up being, and you will up to how much cash required for settlement costs. You’ll be able to utilize the calculator to help you estimate the total month-to-month expenses, see what your repayments was in the event that financial rates rise, and feature what your outstanding balance would be through the years.

When you’re buying yet another family, it is best to use the calculator to see which you really can afford early considering a home postings. When you are renewing or refinancing and understand the overall quantity of the mortgage, utilize the Restoration or Refinance tab so you’re able to imagine mortgage payments instead accounting to have a deposit.

Yes, our homeloan payment calculator is free of charge. Actually, the calculators, stuff, and you will price review tables are 100 % free. produces money due to advertising and commission, instead of because of the billing users. I promote a reduced pricing inside the each province supplied by brokers, and allow these to visited customers on the internet.

How come the monthly calculator features four columns?

We believe it is necessary on how best to examine the choices front by front side. I start this new calculator by the discussing the four typical alternatives to own downpayment issues, but you aren’t limited by those people choice. I and additionally allow you to are very different amortization several months together with interest rates, so you will be aware how a varying versus. repaired home loan rate change your own payment.

Just how can money differ of the state when you look at the Canada?

Most mortgage controls for the Canada is uniform along side provinces. This includes minimal down-payment of five%, plus the limit amortization months thirty-five age, particularly. not, there are financial statutes one to will vary anywhere between provinces. Which dining table summarizes the distinctions:

What is CMHC Insurance policies?

CMHC insurance policies (or mortgage standard insurance policies) handles lenders off mortgage loans you to default. CMHC insurance is required for everybody mortgages in the Canada having off payments out-of lower than 20% (high-proportion mortgage loans). That is an additional cost to you, and is computed as a share of the overall home loan number. For additional information on financial default insurance policies, please see all of our guide to mortgage standard insurance policies (CMHC insurance policies).

What is a keen amortization agenda?

A keen amortization plan shows their monthly obligations over time and also means the new part of per commission settling their prominent vs. appeal. The utmost amortization within the Canada try 25 years to the off costs less than 20%. The most amortization period for all mortgages are 35 ages.

Regardless if the amortization is twenty five years, their label would-be much shorter. With prominent title into the Canada getting five years, your own amortization was right up getting revival prior to the financial is reduced, this is exactly why the amortization agenda demonstrates to you the bill out of your own mortgage at the conclusion of the title.