A medical disaster may installment loans Columbus no credit check come slamming within an individual’s doorway when an excellent people the very least expects it. While most of us prepare for it by purchasing medical insurance, more often than not, this type of guidelines usually do not security all aspects of a healthcare statement. Issues such as inadequate sum covered, an ailment not getting secured according to the coverage, otherwise a medical facility maybe not listed on the committee regarding insurer’s TPA (3rd party Administrator), can be impede your expected procedures. A-sudden necessity of particularly characteristics could have you playing around requesting financial help out-of relatives and buddies. In such cases, a choice source of financing for example an unsecured loan will come to your help. We have found all you need to find out about unsecured loans and you will why you need to grab her or him in the event of a medical emergency.

A consumer loan having a health disaster was a fast mortgage facility you could grab throughout the an overall economy such as for instance a great scientific emergency. Of a lot banks and NBFCs (Non-Financial Monetary Businesses) give that it disaster loan to have big scientific expense, session fees, diagnostics, etcetera.

Listed below are some Key Advantages of Bringing a personal loan to own Medical Problems:

? Fast Processing: Respected loan providers understand the importance from a health emergency, as well as offer a whole digitized application procedure with reduced files, hence allowing you to discovered fund quickly . That loan to possess a healthcare emergency is approved easily and paid directly to a borrower’s account in one day or several, or sometimes even in the course of time. Yet not, it is crucial that individuals meet with the qualifications requirements.

? No equity: As this is an enthusiastic unsecured emergency financing you don’t need to care about pledging equity otherwise defense for it mortgage.

? High amount of loan: One can possibly use to INR twenty five lakhs* while the an unsecured loan to possess a medical crisis so you can fulfil all of the medical requirements effortlessly.

? Treatment everywhere: You should use it loan amount in any healthcare otherwise private treatment middle getting investing expense, diagnostics, etcetera.

? Availability of all the healthcare facilities: Instead of health care insurance guidelines where simply minimal circumstances or measures get covered, al types of procedures try you’ll be able to which have a health crisis mortgage.

? Attractive Rates: Some lending establishments promote glamorous interest levels so you’re able to borrowers with high qualifications. The eligibility to possess a personal loan very utilizes your revenue, years, credit rating, repayment facility or other affairs. Creditors for example Fullerton India has smooth qualifications standards and online app process that allows you to within the satisfying your own scientific mortgage criteria easily.

? Instantaneous Funds: Just like the verification and you can file research procedure has been accomplished successfully, the financial institution will approve your loan, just after that you will get the mortgage matter.

? Flexible Installment: Come back the medical crisis financing which have Equated Monthly Instalments (EMIs). For many Banking institutions NBFCs, the standard fees months is between 12 so you’re able to sixty weeks.

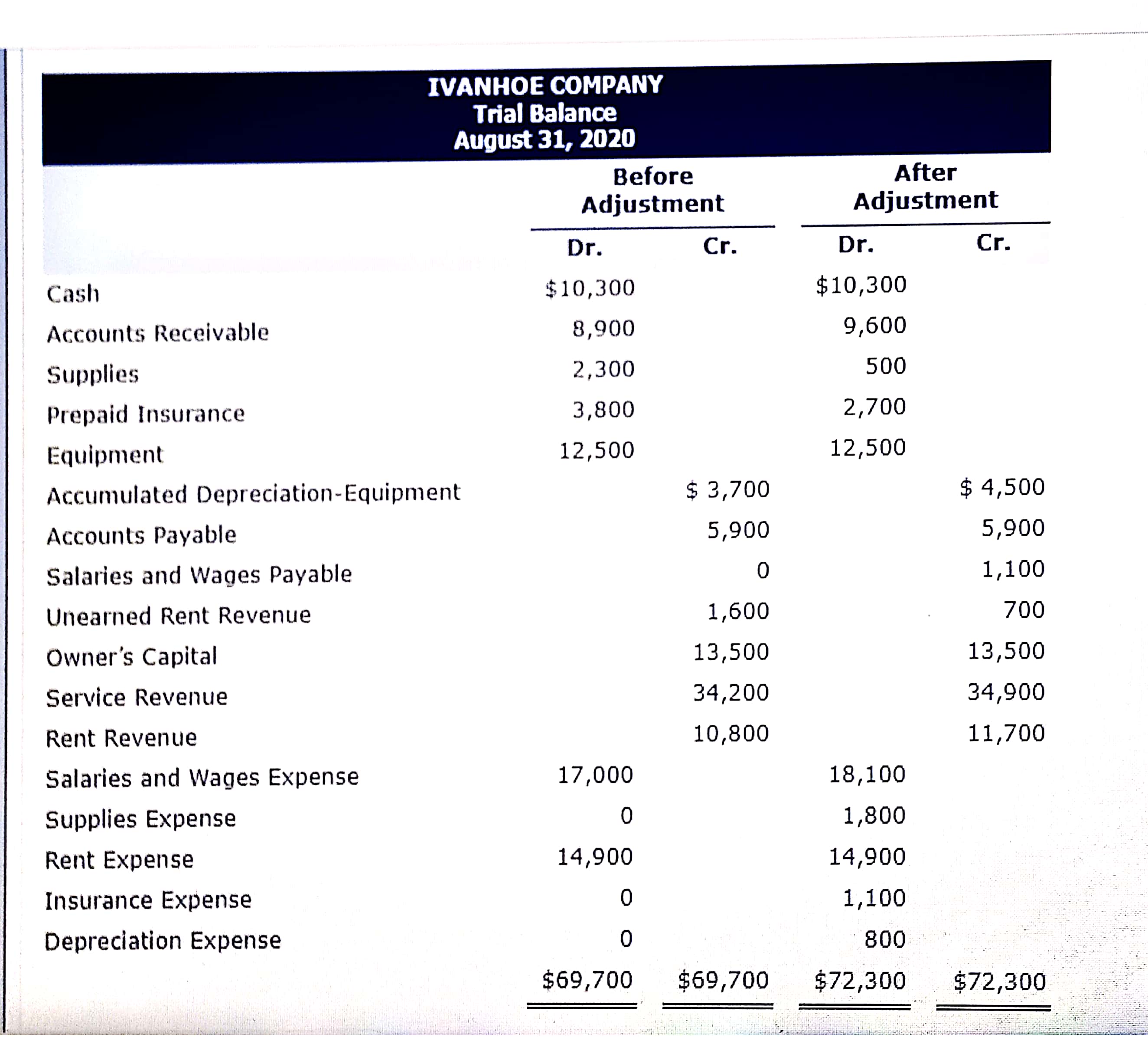

EMI Calculations getting Scientific Financing:

Equated Monthly Instalment is the count one to a debtor pays every week towards financial or NBFC to take the mortgage. Its calculated according to research by the loan amount, period rate of interest. Brand new formula so you can determine EMI are,

Given that interest levels vary for various financial institutions NBFCs, new EMI are very different. It is vital that you always determine the EMI that suits your income and you may appropriately choose suitable tenure towards the medical financing.

Software Procedure for a healthcare Financing:

? Favor a reputed financial whose consumer loan qualifications requirements fits the reputation while offering the borrowed funds from the an aggressive rate of interest. Discover greatest loan amount you desire on the medication by checking the maximum amount you might be eligible for playing with a unsecured loan qualifications calculator.

? To apply, look at the lender’s website otherwise install its mobile app. Sign in the mobile amount having OTP verification to begin with their travels

? Once your documentation and you can confirmation process are properly completed, the brand new acknowledged funds could well be paid toward family savings.

A personal bank loan is a boon, particularly in issues. This new quick and easy recognition techniques, lowest documents and quick disbursal becomes a life saver. So the next time you or your spouse you desire hospital treatment and you need to plan small loans, you can desire make an application for a consumer loan.